Investors are counting on the British company to revive their fortunes

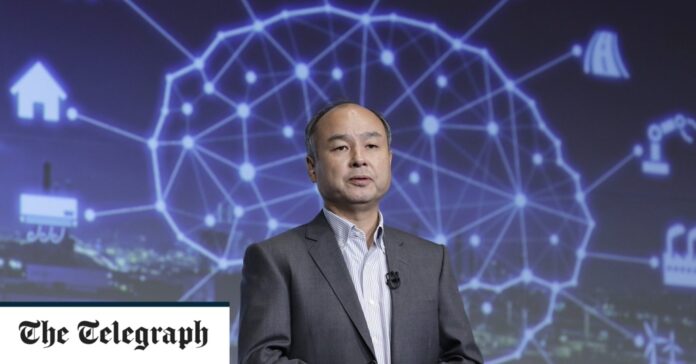

Masayoshi Son has a lot riding on the success of Arm’s impending New York listing. The outspoken Japanese billionaire, briefly the world’s richest man, seems to have had more go wrong than right in recent years.

After buying Cambridge-based Arm in 2016, Mr Son’s SoftBank conglomerate made a series of optimistic tech bets that have failed to pay off, including huge investments in WeWork, Uber and DoorDash. Last year, the company’s investment vehicle, the Vision Fund, lost $32bn (£25bn).

Arm is expected to be valued at roughly double the £24bn SoftBank paid for the company seven years ago. If this holds, it will count as some evidence that Son still has something of a Midas touch.

But he is not the only one praying that Arm’s flotation will be a triumph. After a post-pandemic slump in tech valuations and funding, investors looking for the next Google and entrepreneurs seeking to strike it rich are counting on the British company to revive their fortunes.