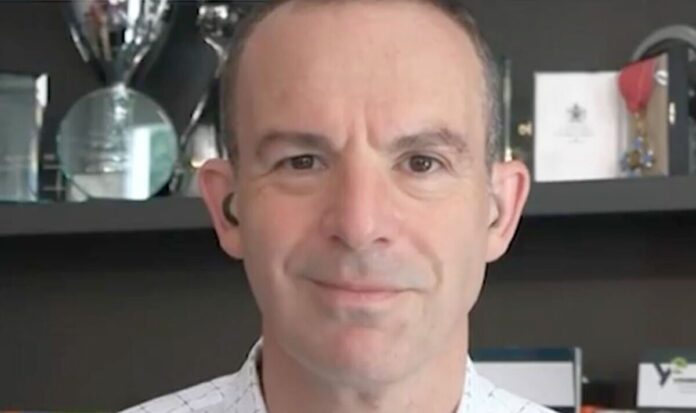

Martin Lewis has suggested whether people should stop paying into their pensions , to help afford the rising mortgage costs. On ITV’s This Morning today, Carol wanted to know if her son should decrease his pension contributions as his mortgage is going up by £250 in September. She said: ‘My son is 30 and his fixed-rate mortgage finishes in September. ‘He has acquired a new fixed rate, but it will cost him another £250 each month in payments. ‘He currently pays 11 percent into his workplace pension and he’s considering putting it down to five percent to help pay his increased mortgage payments in the future. Is that a good move?’ Martin Lewis has suggested whether people should stop paying into their pensions (Image: GETTY) The Bank of England recently increased the base rate to five percent (Image: GETTY) The Bank of England recently increased the base rate to five percent. This is the 13th consecutive base rate rise the bank has approved, pushing mortgage rates up further and further. This puts pressure on those coming off a fixed deal as their repayments could soar as rates are much higher than they were years ago. Higher mortgage rates are inevitable for thousands across the country this year. Mr Lewis said Britons will have to find a way to meet the difference. He said: ‘My instinctive answer is I don’t like anyone taking money from their pension. The more you put in now, the better retirement you will be able to have. But he’s putting a decent whack in. 11 percent is a lot. Carol’s son would pay £250 extra each month (Image: GETTY) ‘If it’s an employment pension then he will be auto-enrolled which means his employer must also contribute.’ He explained that the minimum people have to put in their workplace pension is eight percent. Individuals have to put in five percent and their employers put in three percent. Mr Lewis continued: ‘What you don’t want to do is make them contribute less than they are willing to because that’s effectively giving money away from your employer. ‘Of course, it takes money out of your pay packet for now, but you’ll get it back later. But you’re effectively giving away a pay rise. He’s way above the minimum. I don’t like people reducing their pension, but he’s got a lot.’ He explained that if there’s no room anywhere else – after he’s gone through every bill, made sure he’s on the cheapest for everything and made sure he’s cut back before taking from the pension, then it could be necessary. Mr Lewis added: ‘I don’t like it but sometimes it’s necessary.’ He encouraged people to use the moneyhelper.org website to get free one on one pension guidance if someone is struggling and unsure what they can do. This Morning continues at 10am tomorrow on ITV.

Martin Lewis explains whether to limit pension contributions to afford mortgage

Sourceexpress.co.uk

RELATED ARTICLES