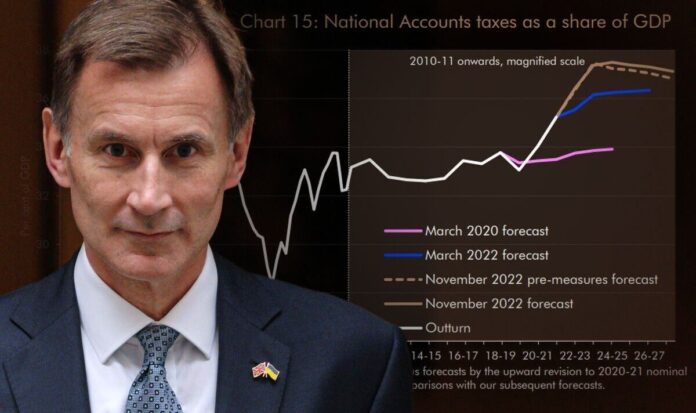

UK taxes are set to rise to their highest level in relative terms since World War 2, following Jeremy Hunt’s Autumn Statement. A chart produced by the Office for Budget Responsibility shows that taxes as a share of GDP will reach more than 37 percent in the year 2023-2024. In 1948, after World War 2 came to end, they reached the same level as a proportion of GDP.After the year 2023-23, taxes as a proportion of GDP will plateau.The Chancellor announced a £55billion plan for tax hikes and public spending cuts in his Autumn Statement in the House of Commons this morning.Mr Hunt’s package included around £30billion in spending cuts and £24billion in tax rises over the next five years.He announced that the threshold for paying the 45p rate of tax would be reducded from £150,000 to £125,140 from 6 April 2023. UK taxes are set to rise to their highest level in relative terms since World War 2 (Image: HMT/Getty)Meanwhile, the income tax personal allowance, higher rate threshold, main national insurance thresholds and inheritance tax thresholds will be frozen until April 2028.This will mean that more Britons are likely to end up with more tax, as they will be dragged into higher bands as a result of soaring inflation.Mr Hunt also announced a new windfall tax on energy firms, which will be used to help pay for Government support for household energy bills.Despite previous Government objections to a windfall tax, Mr Hunt told the Commons: “I have no objection to windfall taxes if they are genuinely about windfall profits caused by unexpected increases in energy prices. The Chancellor announced a £55billion plan for tax hikes and public spending cuts (Image: Getty) Tax as a percentage of GDP (Image: HMTreasury )”But any such tax should be temporary, not deter investment and recognise the cyclical nature of many energy businesses.”It is hoped the windfall taxes can raise around £14billion next year.Mr Hunt’s Autumn Statement also saw the Government announce a number of support measures, including confirmation that they would be keeping the pensions triple lock in place.The announcement is a major win for the Express, which has been campaigning to keep the policy since it was thrown into doubt when Mr Sunak became Prime Minister last month. Impact of income tax threshold changes (Image: Express)The Government also committed to uprate benefits in line with inflation, a policy which will cost the public purse £11billion.While Mr Hunt accepted that “difficult decisions” were being taken, he said the plan would “strengthen our public finances, bring down inflation and protect jobs.”A Downing Street Official said that growth is the “single biggest barrier to inflation”. The Government also committed to uprate benefits in line with inflation (Image: Getty)While they said that the Government’s priority is “sound money and low taxes”, they acknowledged that “sound money must come first”.Speaking about the plan, the official added: “These policies will reduce inflation. We’re all going to feel the pain of rabid inflation driven by energy prices.”Inflation is the insidious tax eating into our household budgets and savings”.