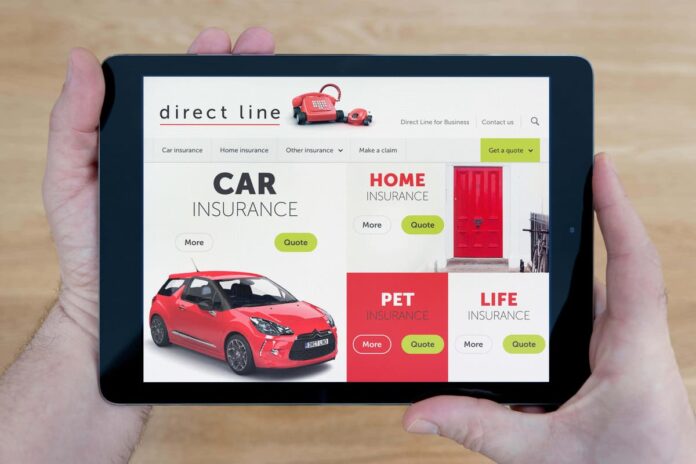

Direct Line is set to pay out around £30 million in compensation to customers who were overcharged when they renewed their car or home insurance . The insurer admitted to an ‘error’ in implementing the financial watchdog’s new pricing rules which came into effect at the start of 2022. The error meant existing insurance customers were charged more for their renewal than they would have done if they were a new customer, the Financial Conduct Authority (FCA) said. The admission comes after The Independent revealed that almost 12,000 complaints were received by the Financial Ombudsman Service (FOS) in the past year – a four-year high – making car insurance the third most complained-about financial product , behind current accounts and credit cards. The revelation follows this newspaper’s expose into the great car insurance con , which found that car insurance premiums have been hiked by 48 per cent over the past year. Car insurance is now the third-biggest household bill, behind council tax and energy, with soaring costs driving many motorists to sell up . Direct Line was forced to act after the FCA brought in new rules last year, which prevent renewing home and motor insurance customers from being charged higher prices than a new customer would be charged. ‘An error in our implementation of these rules has meant that our calculation of the equivalent new business price for some customers failed to comply with the regulation,’ Direct Line admitted. ‘As a result, those customers have paid a renewal price higher than they should have.’ News comes after The Independent revealed car insurance premiums have soared 48 per cent in past year The insurance company said it has launched a review into its past policies. Direct Line did not specify how many people were expected to be compensated but it estimated that the total payments to affected customers would be in the region of £30 million. Not all customers who have renewed their home or car insurance since the FCA’s new pricing rules came into effect will have been overcharged, it is understood. Direct Line said it would be contacting affected customers directly, and customers do not need to do anything themselves at this stage. The company has ramped up prices across its motor and home insurance policies this year as the cost of claims soared. On Wednesday, the group said it had appointed Adam Winslow from rival Aviva as its new chief executive, and he will take the reins in the first quarter of 2024.

Direct Line to pay out £30m to customers overcharged on car or home insurance

Sourceindependent.co.uk

RELATED ARTICLES