The typical mortgage holder is now paying an extra £220 a month when they go to re-mortgage and it is said to be “devastating” the construction industry

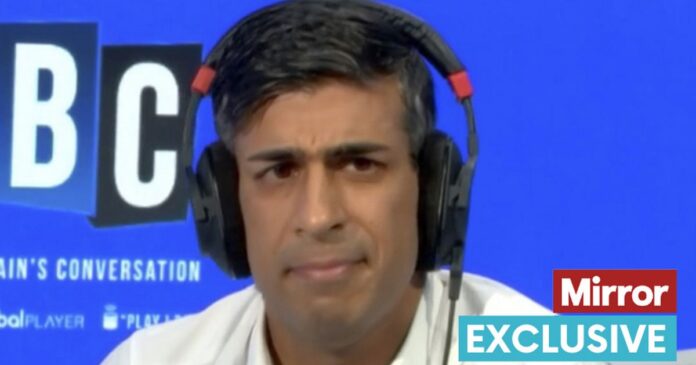

Housebuilding is slowing down as construction firms struggle with “planning issues” after Rishi Sunak tore up rules setting local targets for new homes, the Bank of England has warned.

The warning came in a report from the Monetary Policy Committee (MPC), released after the Bank increased the base rate to 5.25%.

The typical mortgage holder is now paying an extra £220 a month when they go to re-mortgage, according to the Bank of England’s number crunching. The MPC report stated that “construction output remained at relatively low levels and had declined further” and “rising costs, labour shortages and planning issues in particular were still delaying or disrupting building projects”.

It went on to say that “some house builders were downgrading build plans and pausing some schemes” and, as a result, there was an increase in the number of construction firms “entering insolvency procedures”. The bleak assessment comes after more than 200 housebuilders last month delivered a devastating warning to the Prime Minister, saying that “it has never been more difficult to be an SME developer than it has at the present time” and that they are “facing multiple existential threats to the survival of our businesses”.