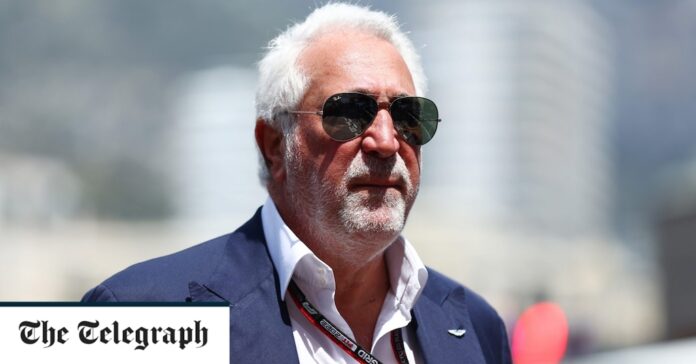

Mr Stroll’s investment vehicle Yew Tree now owns 23.3pc of the company

Canadian billionaire Lawrence Stroll has tightened his grip on sports car maker Aston Martin, leading a £30m investment in its shares.Yew Tree, Mr Stroll’s investment vehicle, now owns 23.3pc of the company, after he added a 4.25pc stake. Other investors include Saudi Arabia’s Public Investment Fund with 16.7pc and Chinese car maker Geely with 7.6pc.Mr Stroll and co-investors including JCB’s Lord Anthony Bamford and biotech billionaire Ernesto Bertarelli bought in because the shares are cheap, he said.The move comes after a failed attempt during the summer by Geely to take control of the company by offering a huge capital injection in exchange for control of Aston Martin.The company has suffered numerous setbacks since floating on the London Stock Exchange in 2018 and it has lost about 90pc of its value. It has been lossmaking since then, weighed down by the cost of the listing, high debt costs and supply chain problems interfering with production.

As executive chairman of the company, Mr Stroll has sought to end Aston Martin’s prior habit of overproduction, which led to dealers cutting the price of cars and eroding the company’s margins. He also oversaw a £653m capital raise from existing investors and fresh cash from Saudi Arabia’s sovereign wealth fund.It was this share sale which allowed Geely to buy its stake. Geely already owns Lotus in the UK, Sweden’s Volvo and half of the Smart brand set up by Mercedes, as well as the London Electric Vehicle Company, which produces electrified black cabs.Aston Martin’s most recent headache is a weaker pound which has made Aston’s debt, nearly all of which is in dollars, much more expensive to service.Mr Stroll said: “As a group of investors we share a firm belief that Aston Martin is undervalued and that, despite the recent supply chain challenges, it is well set to continue its growth trajectory in the ultra-luxury high performance automotive business. “Our collective confidence in the medium and long term success of the business is driven by the strength of the order book, the exciting portfolio of new products that are set to come to the market and Aston Martin’s incredible global brand awareness.”

We rely on advertising to help fund our award-winning journalism.

We urge you to turn off your ad blocker for The Telegraph website so that you can continue to access our quality content in the future.